Macroeconomics unit 4 answer key – Unveiling the intricacies of macroeconomics unit 4, this comprehensive guide delves into the fundamental concepts that underpin economic growth, stability, and international trade. Through a detailed examination of GDP, fiscal and monetary policies, economic development, and international macroeconomics, we provide a thorough understanding of the key drivers that shape economic landscapes.

As we navigate through this exploration, we will uncover the interconnectedness of macroeconomic variables, the role of government intervention in economic management, the influence of central banks on monetary policy, and the challenges and opportunities faced by developing economies. By gaining a firm grasp of these concepts, individuals can develop a nuanced understanding of the complex forces that shape economic outcomes.

Macroeconomic Variables and Relationships

Macroeconomic variables are broad measures that provide an overall picture of the economy’s performance. They include measures of output, income, employment, and prices. These variables are interconnected and can influence each other in various ways.

Gross Domestic Product (GDP)

GDP is the total value of all goods and services produced within a country’s borders over a specific period of time, typically a quarter or a year. It is the most widely used measure of economic output and is a key indicator of the economy’s health.

GDP can be calculated using three different approaches: the expenditure approach, the income approach, and the value-added approach.The expenditure approach measures GDP by adding up all the spending on goods and services in the economy. This includes spending by households, businesses, and government.

The income approach measures GDP by adding up all the income earned by individuals and businesses in the economy. The value-added approach measures GDP by adding up the value added at each stage of production.GDP is a comprehensive measure of economic output, but it does have some limitations.

For example, it does not measure non-market activities, such as housework or volunteer work. Additionally, GDP can be affected by changes in the price level, which can make it difficult to compare GDP over time.

Inflation

Inflation is the rate at which prices for goods and services increase over time. It is typically measured using the Consumer Price Index (CPI) or the Producer Price Index (PPI). Inflation can be caused by a number of factors, including increases in the money supply, demand-pull factors, and cost-push factors.Inflation

can have a significant impact on the economy. It can reduce the purchasing power of consumers, erode savings, and make it difficult for businesses to plan for the future. High inflation can also lead to social unrest and political instability.

Relationship between GDP and Inflation

GDP and inflation are two of the most important macroeconomic variables. They are often used together to assess the overall health of the economy. In general, a strong economy will have high GDP growth and low inflation. However, it is possible for the economy to experience periods of high GDP growth and high inflation, or low GDP growth and low inflation.The

relationship between GDP and inflation is complex and can be influenced by a number of factors. One of the most important factors is the Phillips curve. The Phillips curve is a graphical representation of the relationship between inflation and unemployment.

According to the Phillips curve, there is a trade-off between inflation and unemployment. In other words, it is difficult to achieve both low inflation and low unemployment at the same time.

Fiscal Policy

Fiscal policy refers to the use of government spending and taxation to influence economic activity. It is a macroeconomic tool that can be employed to manage economic fluctuations and promote economic growth.

Government Spending

Government spending is a significant component of fiscal policy. Increased government spending can stimulate economic activity by increasing aggregate demand. This can lead to higher production, employment, and economic growth. However, excessive government spending can also contribute to inflation if the economy is operating near full capacity.

Taxation

Taxation is another key aspect of fiscal policy. Lowering taxes can increase disposable income for individuals and businesses, leading to increased spending and investment. This can stimulate economic activity. Conversely, raising taxes can reduce disposable income and dampen economic growth.

Effects of Fiscal Policy, Macroeconomics unit 4 answer key

- Inflation:Expansionary fiscal policy (increased spending or reduced taxes) can lead to higher inflation if the economy is operating near full capacity.

- Employment:Fiscal policy can influence employment levels. Expansionary fiscal policy can stimulate job creation, while contractionary fiscal policy can lead to job losses.

- Economic Growth:Fiscal policy can contribute to economic growth by stimulating aggregate demand and promoting investment. However, excessive fiscal stimulus can also lead to inflation and unsustainable debt levels.

Monetary Policy: Macroeconomics Unit 4 Answer Key

Monetary policy refers to the actions taken by central banks to manage the money supply and influence economic activity. Central banks play a crucial role in managing the monetary system by controlling the availability and cost of money.

Monetary policy aims to achieve specific economic goals, such as stable prices, low unemployment, and sustainable economic growth. By influencing interest rates, inflation, and economic activity, monetary policy can help stabilize the economy and promote economic well-being.

Monetary Policy Tools

Central banks use various monetary policy tools to influence economic conditions. These tools include:

- Open Market Operations:Buying and selling government securities to increase or decrease the money supply.

- Reserve Requirements:Setting the amount of reserves that banks must hold, affecting the amount of money available for lending.

- Discount Rate:The interest rate charged to banks for borrowing from the central bank, influencing the cost of borrowing for businesses and consumers.

The effectiveness of monetary policy tools depends on various factors, including the economic conditions, the level of inflation, and the expectations of businesses and consumers.

Economic Growth and Development

Economic growth refers to the increase in the production of goods and services within an economy over a period of time, typically measured as the percentage change in real gross domestic product (GDP). Economic development, on the other hand, encompasses a broader concept that includes not only economic growth but also improvements in living standards, health, education, and other indicators of social progress.There

are numerous factors that contribute to economic growth and development. These include:

-

-*Technology and innovation

Technological advancements and innovations can lead to increased productivity, new industries, and job creation.

-*Human capital

The skills, knowledge, and education of a country’s workforce play a crucial role in driving economic growth.

-*Physical capital

This includes infrastructure, machinery, and other physical assets that facilitate production.

-*Natural resources

Countries with abundant natural resources, such as oil or minerals, may have an advantage in certain industries.

-*Government policies

Government policies, such as fiscal and monetary policies, can influence economic growth and development.

-*International trade

Trade with other countries can expand markets, promote competition, and lead to technology transfer.

Developing economies face unique challenges in achieving sustainable economic growth. These challenges include:

-

-*Poverty and inequality

Poverty and income inequality can hinder economic growth by limiting access to education, healthcare, and other essential services.

-*Political instability

Political instability can create uncertainty for businesses and investors, making it difficult to attract investment and promote economic growth.

-*Corruption

Corruption can divert resources away from productive uses and create barriers to entry for businesses.

-*Lack of infrastructure

Developing economies often lack adequate infrastructure, such as roads, electricity, and telecommunications, which can limit economic activity.

-*Dependence on primary commodities

Many developing economies are heavily dependent on the export of primary commodities, such as oil or minerals, which can make them vulnerable to fluctuations in global demand and prices.

Despite these challenges, developing economies also have opportunities for achieving sustainable economic growth. These opportunities include:

-

-*Rapid population growth

Developing economies often have a rapidly growing population, which can provide a large labor force and a growing market for goods and services.

-*Technological advancements

Developing economies can leapfrog developed economies by adopting new technologies and innovations.

-*Foreign investment

Foreign investment can provide developing economies with capital, technology, and expertise.

-*Regional cooperation

Regional cooperation can promote trade, investment, and economic integration, which can lead to economic growth.

-*Government policies

Governments in developing economies can play a key role in promoting economic growth through sound fiscal and monetary policies, investing in education and infrastructure, and creating a favorable environment for business.

International Macroeconomics

International macroeconomics examines the macroeconomic interactions between countries, focusing on international trade, investment, exchange rates, and the role of international organizations. These factors significantly impact a country’s economic performance and macroeconomic stability.

Importance of International Trade and Investment

International trade and investment promote economic growth and development by allowing countries to specialize in producing goods and services where they have a comparative advantage. Trade facilitates the exchange of goods and services, increasing consumption and production possibilities. Investment, on the other hand, provides capital and technology, enhancing productivity and economic growth.

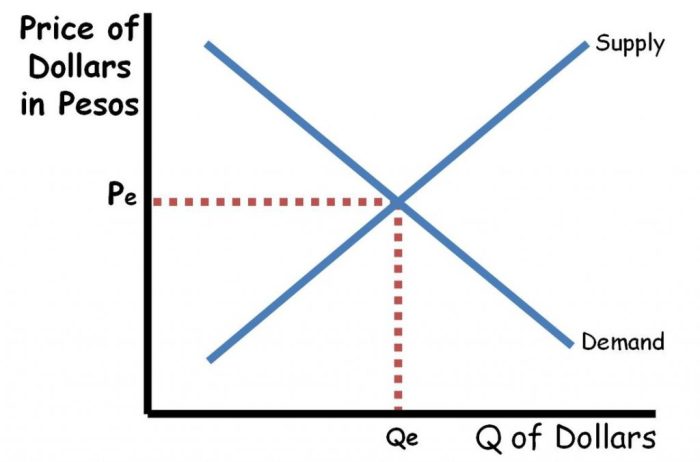

Impact of Exchange Rates

Exchange rates, the prices of one currency relative to another, influence trade and economic growth. A weaker currency makes exports cheaper and imports more expensive, potentially boosting exports and reducing imports. Conversely, a stronger currency has the opposite effect. Exchange rate fluctuations can also impact investment decisions and economic stability.

Role of International Organizations

International organizations, such as the International Monetary Fund (IMF) and the World Bank, play a crucial role in promoting macroeconomic stability. The IMF provides financial assistance to countries facing balance of payments difficulties and promotes sound economic policies. The World Bank supports economic development projects and provides technical assistance to developing countries.

Case Studies

Case studies provide valuable insights into the implementation and effectiveness of macroeconomic policies in real-world scenarios. By examining the experiences of countries that have successfully implemented macroeconomic policies, we can identify best practices and lessons learned. Additionally, analyzing the macroeconomic challenges faced by specific countries and the policy responses adopted can help us understand the complexities of macroeconomic management.

One notable case study is the implementation of macroeconomic reforms in Chile during the 1980s and 1990s. These reforms, which included fiscal discipline, trade liberalization, and financial sector deregulation, led to a period of sustained economic growth and stability.

Macroeconomic Challenges and Policy Responses

Another case study is the response of the United States to the 2008 financial crisis. The Federal Reserve implemented a series of unconventional monetary policies, including quantitative easing and zero interest rates, to stimulate economic growth and prevent a deeper recession.

Effectiveness of Macroeconomic Policies

The effectiveness of macroeconomic policies depends on a variety of factors, including the specific policy, the economic conditions at the time of implementation, and the institutional framework of the country. Empirical studies have shown that fiscal policy can be effective in stimulating aggregate demand in the short run, but its long-run effects are less clear.

Monetary policy has also been shown to be effective in influencing inflation and economic growth. However, the effectiveness of monetary policy can be constrained by factors such as the level of interest rates and the expectations of economic agents.

Q&A

What is the significance of Gross Domestic Product (GDP) in macroeconomics?

GDP serves as a comprehensive measure of the economic activity within a country over a specific period, typically a quarter or a year. It captures the total value of all goods and services produced within the country’s borders, providing a snapshot of the overall economic output and health.

How does fiscal policy influence economic growth?

Fiscal policy, involving government spending and taxation, can be used to stimulate or contract the economy. Expansionary fiscal policy, characterized by increased government spending or tax cuts, aims to boost economic activity during periods of recession or slow growth. Conversely, contractionary fiscal policy, involving decreased spending or tax increases, seeks to curb inflation or excessive economic expansion.

What role do central banks play in monetary policy?

Central banks are responsible for managing the money supply within an economy. Through tools such as interest rate adjustments, quantitative easing, and open market operations, central banks influence the availability and cost of money, thereby impacting inflation, economic growth, and financial stability.