Welcome to the realm of mortgage calculations, where ngpf calculate using a mortgage calculator reigns supreme. In this meticulously crafted guide, we delve into the intricacies of mortgage calculators, empowering you with the knowledge and confidence to navigate the complexities of homeownership.

Brace yourself for an immersive journey that unravels the mysteries of mortgage financing, guiding you towards informed decisions.

As we embark on this exploration, we will dissect the inner workings of mortgage calculators, unraveling their purpose, functionality, and diverse offerings. We will then embark on a practical expedition, demonstrating how to harness the power of these tools to determine monthly payments, interpret results, and uncover advanced features that cater to specific scenarios.

Throughout our discourse, we will illuminate the considerations and limitations of mortgage calculators, emphasizing the significance of seeking professional guidance before making crucial financial commitments.

Understanding Mortgage Calculators

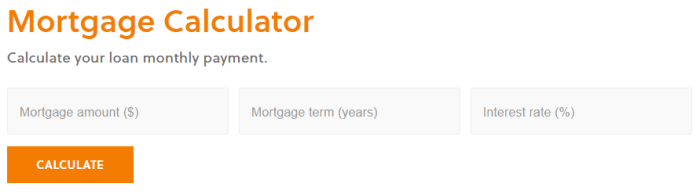

Mortgage calculators are online tools that assist potential homebuyers in estimating their monthly mortgage payments. They simplify the complex calculations involved in determining the affordability of a mortgage loan.

There are various types of mortgage calculators available, each designed for specific purposes. Basic calculators provide an estimate of monthly payments based on loan amount, interest rate, and loan term. Advanced calculators offer additional features, such as the ability to compare different loan scenarios, calculate closing costs, and factor in property taxes and insurance.

Examples of Mortgage Calculators

- Bankrate Mortgage Calculator: A comprehensive calculator with advanced features, including the ability to compare multiple loan scenarios.

- Zillow Mortgage Calculator: A user-friendly calculator that provides estimates for monthly payments, closing costs, and property taxes.

- NerdWallet Mortgage Calculator: A calculator that offers insights into the affordability of a mortgage based on income and expenses.

Using Mortgage Calculators to Calculate Monthly Payments: Ngpf Calculate Using A Mortgage Calculator

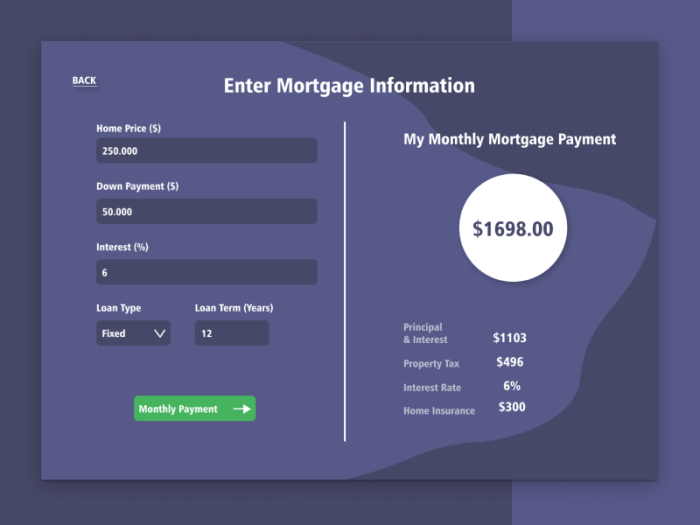

Using a mortgage calculator is straightforward. Enter the loan amount, interest rate, and loan term into the calculator. Some calculators may also ask for additional information, such as property taxes and insurance.

Once the inputs are entered, the calculator will display the estimated monthly payment. This payment includes principal, interest, property taxes, and insurance (if applicable).

Example, Ngpf calculate using a mortgage calculator

Let’s say you are considering a $200,000 mortgage with a 30-year term and an interest rate of 4%. Using a mortgage calculator, you determine that your estimated monthly payment would be $1,024.

Interpreting Mortgage Calculator Results

Mortgage calculator results provide insights into the affordability of a mortgage loan. The results typically include the following components:

- Principal: The amount of the loan that is being repaid over the loan term.

- Interest: The cost of borrowing the money.

- Property taxes: The annual taxes levied on the property.

- Insurance: The cost of insuring the property against damage or loss.

To determine affordability, it is important to compare the estimated monthly payment to your income and expenses. A general rule of thumb is that housing costs should not exceed 28% of your gross income.

Advanced Mortgage Calculator Features

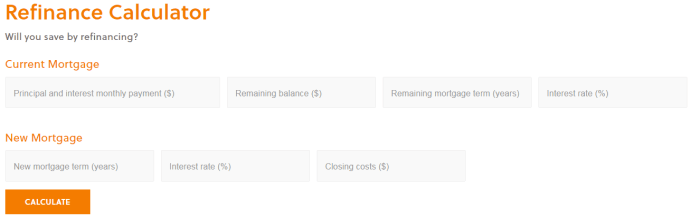

Some mortgage calculators offer advanced features that can enhance the accuracy and usefulness of the calculations. These features may include:

- Amortization schedule: A table that shows how the loan balance is reduced over the loan term.

- Comparison of different loan scenarios: The ability to compare multiple loan options with different interest rates, loan terms, and down payments.

- Closing cost calculator: A tool that estimates the one-time costs associated with obtaining a mortgage loan.

Advanced features can be particularly useful for homebuyers who are considering complex loan scenarios or who want to explore different options before making a decision.

Considerations for Using Mortgage Calculators

While mortgage calculators are valuable tools, it is important to use them responsibly and with an understanding of their limitations:

- Assumptions: Mortgage calculators rely on certain assumptions, such as a fixed interest rate and property taxes. These assumptions may not always hold true.

- Accuracy: Mortgage calculators are only as accurate as the inputs provided. It is important to ensure that the information entered is correct.

- Consultation: Mortgage calculators should not be used as a substitute for professional advice. It is advisable to consult with a financial advisor before making any decisions based on mortgage calculator results.

By using mortgage calculators wisely, potential homebuyers can gain valuable insights into the affordability of a mortgage loan and make informed decisions about their home financing options.

FAQ Corner

What are the different types of mortgage calculators available?

Mortgage calculators vary in their complexity and features. Some basic calculators provide estimates of monthly payments, while advanced calculators allow for detailed analysis of different loan scenarios, including adjustable-rate mortgages and bi-weekly payment options.

How do I interpret the results of a mortgage calculator?

Mortgage calculator results typically include a breakdown of principal, interest, taxes, and insurance. By analyzing these components, you can assess the affordability of a mortgage and make informed decisions about loan terms and down payment options.

What are the limitations of mortgage calculators?

Mortgage calculators are valuable tools, but they have limitations. They rely on assumptions about interest rates, property taxes, and insurance costs, which may change over time. It’s essential to consult with a financial advisor to verify the accuracy of calculator results and consider your individual circumstances.